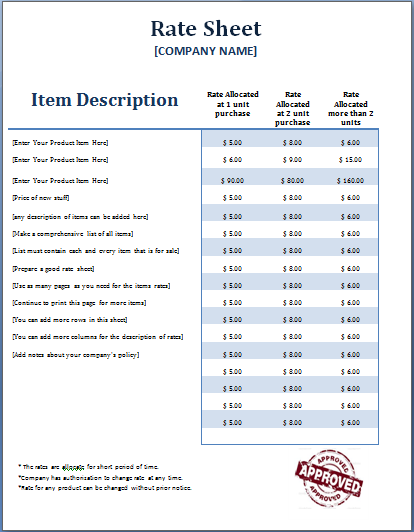

A rate sheet is a document that details the terms and rates for a lender’s unique collection of loan products. The rate sheet is typically used by mortgage brokers, banks, real estate agents, and other lending institutions to inform prospective borrowers about the terms and conditions of their loan packages.

A rate sheet normally includes information such as the loan type, interest rate, loan points or fees, and annual percentage rate (APR). Rate sheets reduce financial risk and increase communication and collaboration among lending institutions and their potential borrowers.

Utilization of the rate sheet

Borrowers benefit from the rate sheets in decision-making since it helps them to compare the many loan products offered and make an informed decision about which loan is best for them. Similarly, a rate sheet is particularly crucial in the mortgage sector since mortgage brokers use it to establish the interest rate, they would charge a borrower.

The broker would often utilize the rate sheet to identify the best available rate for a certain loan product and then charge the borrower a markup known as a yield spread premium.

Banks also use rate sheets as a pricing tool, determining loan interest rates based on market conditions, business plans, and their cost of capital. To explain loan products and pricing to potential borrowers, loan officers, and mortgage brokers, banks operationalize these sheets.

Rate sheets assist banks in informing the public about their lending products and pricing, as well as to recruit new customers. Banks also use rate sheets to communicate with investors by informing them about the terms and pricing of the loans they are willing to fund. This information is utilized by investors to estimate the risk and potential return of investing in the loans supplied by the bank.

Significance of the sheet

Rate sheets are normally updated daily or weekly, and rates might fluctuate based on various factors such as market circumstances and the lender’s business plan. It aids borrowers in understanding the costs of a loan, such as the interest rate and any points or fees that may be levied. Compare the various loan alternatives accessible to them and make an educated decision on which loan is best for their needs.

Understand the charges of a loan, such as the interest rate, points, and fees, so that they may budget accordingly. Determine the lender’s underwriting rules, which include credit score requirements, paperwork requirements, and any additional requirements that borrowers must meet.

Borrowers should also be aware that the interest rates mentioned on a rate sheet are not guaranteed and may vary before the loan is authorized. Rate sheets include information regarding the lender’s underwriting rules, such as credit score requirements and documentation required for the loan application, in addition to interest rates and loan terms.

It may also contain information regarding unique programs or incentives offered by the lender, such as first-time homebuyer programs or low-down-payment alternatives.

Conclusion

Overall, a rate sheet is a useful tool for borrowers and lending institutions to comprehend the terms and expenses of various loan packages. Borrowers should thoroughly analyze the rate sheet and search around to get the best loan programs for their circumstances.

[Template]

Download size: 212 KB