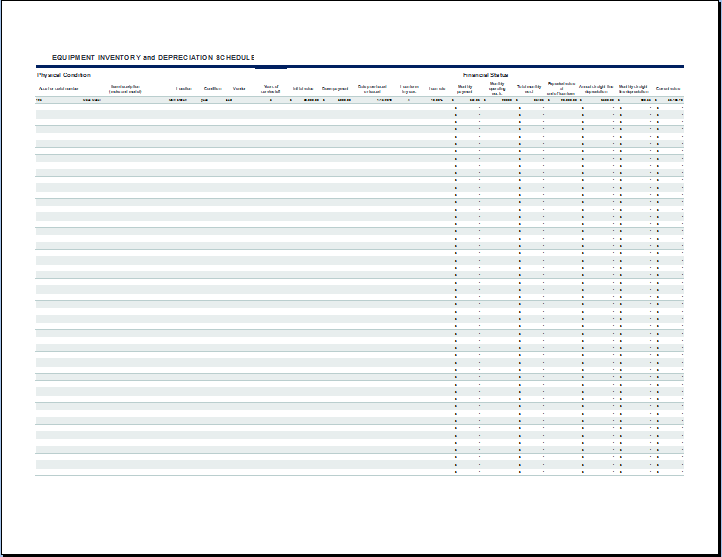

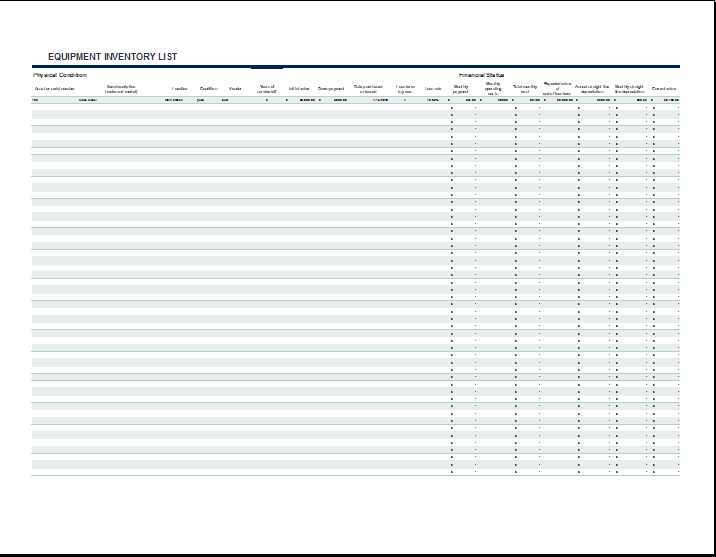

Equipment inventory refers to the listing of all the products or things owned by a business. These items may include the products of their business in the collection or all the things available at the store at a given moment.

Depreciation value is used for the decreasing worth of an item or product over time because of it being used. The value of products loses as soon as they are opened because an unopened and fresh product has increased worth. With continual usage, every piece of equipment needs either a replacement or an upgrade.

Equipment inventory is considered very important for a business because it helps them in listing all the items owned by them so they can be sure that they can carry out functions for a specific period of time. In addition to products, the equipment inventory of a business also includes all the computers, printers, electronic card devices, receipt papers, staplers, etc. Every item is necessary for proper functioning without any hassle.

Each piece of equipment has a different depreciation value…

Each piece of equipment has a different depreciation value because its values depend on various factors such as frequency of use, cost, method of use, etc. Following this, the depreciation value of computers is usually slow because it takes longer for computers to completely wear out and stop functioning. Similarly, staplers can be filled again, calculator batteries can be changed for use. All this equipment has a low depreciation value which gives it more time to use.

Many items i.e. scotch tape, stationery paper, receipts cannot be used again therefore, and their depreciation value is high and should be replaced soon. Businesses prefer to arrange a depreciation schedule for all their inventory to make sure that non-functioning items are removed and backed up with enough stock to replace these items.

To arrange a depreciation schedule for all the equipment inventory owned by a business, the following procedure can be used,

- List out all the equipment that is essential for running a successful business.

- Determine the original cost of equipment along with its useful time period and frequency of use.

- Use a depreciation method for determining the shelf life of the equipment.

- Calculate depreciation expense for every piece of equipment and keep a record of every item.

- Stock up all the items that have high depreciation value and require regular replacement.

- Record all the repairs and update procedures that are conducted on the equipment to get a final depreciation expense.

Equipment inventory with a depreciation schedule is usually maintained on online portals and can be accessed even after many years. These online portals help in editing and recording huge amounts of data.

There is a reason it is important…

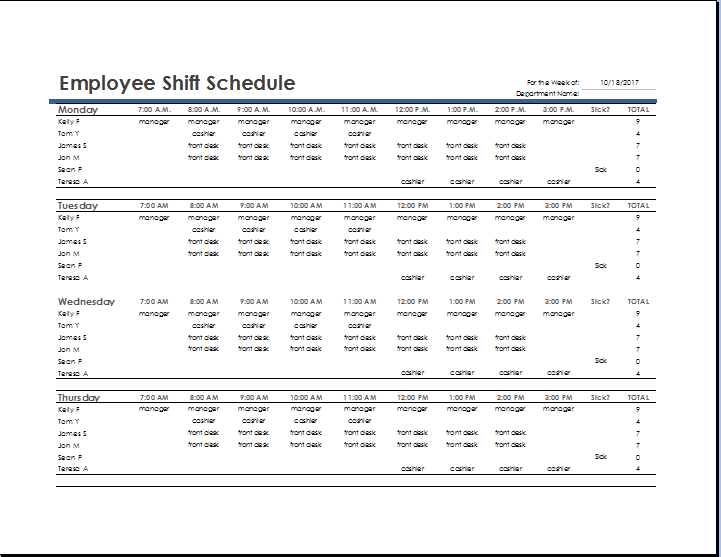

Depreciation schedules are considered very important for a functioning business because of the following reasons,

- It keeps the owners aware of their equipment inventory and helps them in stocking up the items that they require.

- The depreciation value for every piece of equipment tells about the juice left for working therefore, it prepares them for finding a replacement.

- It records all the assets of a business and helps them in knowing about their strengths and makes sure that all the assets are accounted for.

Preview