A good financially planned life always improves the dynamics and makes living easier. As it is said that one should cut one’s coat according to one’s cloth, it can be put to reality, if one knows the exact details of one’s cash-generating resources as well as one’s expenses. It becomes smooth to manage oneself in terms of finances, with having an understanding of how much is coming, and how much is being spent. A personal cash flow statement is a tool, that is used by individuals, to monitor their cash inflows and expenses as well as to overall manage themselves financially.

What is a personal cash flow statement?

A personal cash flow statement reflects the net cash flow owned by an individual. A person may have one or various sources to earn cash and similarly may have different expenses to pay in cash as well. In addition, an individual may have some cash as savings from the past. These items are recorded in this statement. When the total expenses are deducted from the total cash, the result is the net cash flow, which is one of the measures of the individual’s financial worth and creditworthiness.

What are the advantages and disadvantages of a personal cash flow statement?

This statement has both pros and cons attached to it, which are stated below.

- Aids in the management of cash and expenses.

As it shows the available cash that one has, the expenses can be managed accordingly, so that a loan or a debt can be avoided.

- Helps in the assessment of one’s liquidity and net worth in terms of cash.

As this statement indicates the net cash of a person, it aids in the assessment of his/her creditworthiness. A financial institution may demand it when it is lending money.

- Improved utilization of resources.

If the statement indicates that the cash in hand is beyond one’s requirement, the person will put it to better use, such as in investments.

- Highlights the need to earn more cash.

If the cash outflow is higher than the cash inflow, using this statement, one would know, that he either has to control his expenses or has to find other sources of income and cash, to at least balance his cash position.

Despite a large number of advantages, this statement has, it does not exhibit the total worth of an individual, as it does not account for the assets and liabilities, which are on an accrual basis.

What are the components of a personal cash flow statement?

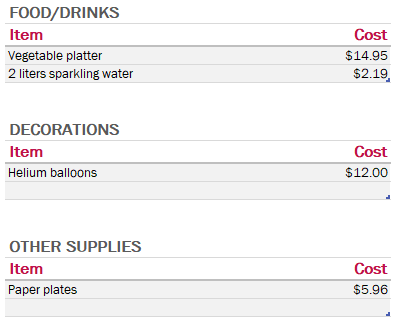

There are few general categories in this statement, which are listed below. However, the columns and rows of a spreadsheet may vary from one person’s requirement to another’s.

- Cash in hand from previous time-period.

- Cash inflow from the usual income sources.

- Additional cash, such as gifted money.

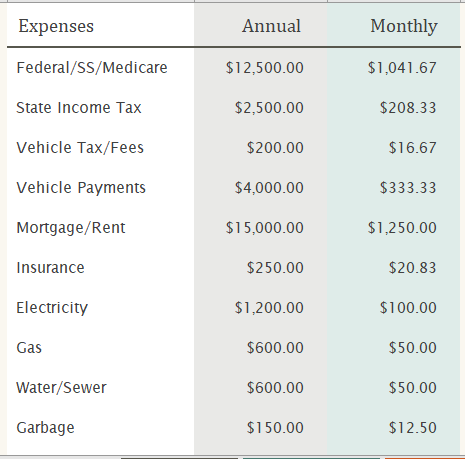

- Fixed expenses, such as rent.

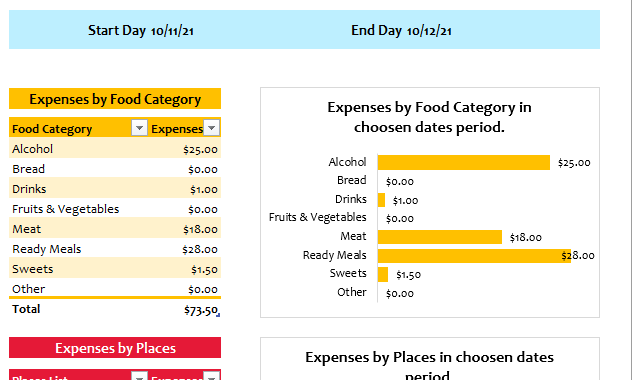

- Variable expenses, which varies from one time-period to another, and need to be paid in cash.

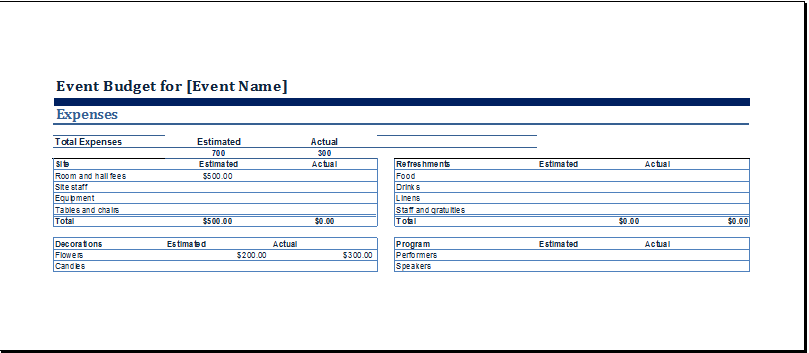

- Any extra expenses.

- Total cash.

- Total cash outflow for the expenses.

- Net cash flow.

Preview