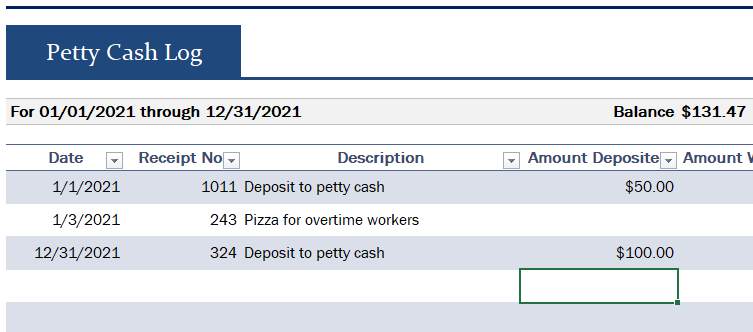

Petty Cash Log Sheet for Small Business

Usually, the small organizations keep their cash in the banks. However, some cash is kept in hand to cover the day-to-day expenses, that need to be paid immediately, or in physical cash. This type of cash is referred to as petty cash. For small businesses, petty cash is important, as their accrual-based expenses are lesser than the cash-paid expenses. It is essential to record all the transactions, that the business does with its petty cash, which becomes possible by using a petty cash log worksheet for a small business.

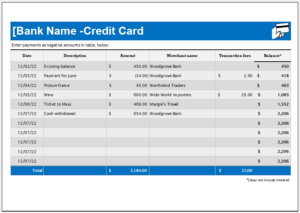

What is a petty cash log worksheet for a small business?

This worksheet keeps a track of the record of the cash in and cashes out of all the transactions in the petty cash account. Usually, the data is inserted daily, but the worksheet maintenance policy can be different for different businesses. The day-to-day expenses, such as the refreshments for meetings, small quantity and quick replenishing of the office stationery supplies, etc., are all recorded in this worksheet. It can be manually maintained on paper or can be maintained on Excel on the computer.

What are the advantages of a petty cash log worksheet for a small business?

This type of worksheet has many benefits, for instance:

- Records all the transactions.

It helps in keeping a track of all the cash inflows and outflows. In addition, it becomes easy for the employees to insert the data of the transactions when a properly designed worksheet is provided to them. Further, to look at the details of any transaction, the business can refer to this worksheet.

- Helps in the balancing of the financial statements.

If there is a discrepancy in the cash in the financial statements, this worksheet can aid in finding the reason and may help in resolving it.

- Indicates fraud.

If the cash in hand and the recorded information do not match, it might mean an employee is committing fraud, and then, the required measures can be taken by the organization.

- Aids in the cash management.

As the worksheet would clearly indicate the cash balance of the petty cash, the business would know, when to withdraw more money to keep it as petty cash, and hence, the issues related to the immediate payments can be avoided.

What are the main components of a petty cash log worksheet for small businesses?

The petty cash log worksheet can be designed with the fields, that are the organization’s requirements. However, generally, the following information is contained in such worksheets for a small business:

- Date.

- Cash inflows.

- Details of the cash source.

- Receipt number.

- Cash outflows.

- Details of the expense or purpose of the payment.

- Bill number.

- Brought forward cash from the previous period.

- Net cashflow.

- Signature of the preparer.

- Signature of the receiving authority.

The large organizations would have a separate petty cash account in the bank, and they often give cheques to make the payments. However, usually, the small organizations keep the cash in hand, physically, so to limit the steps for the immediate payment.

Preview

← Previous Article

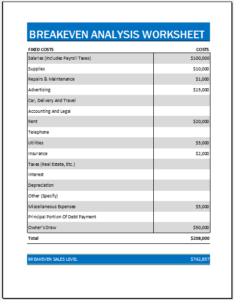

Profit Loss Statement Worksheet for Small BusinessNext Article →

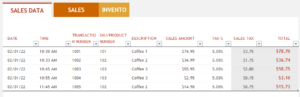

Small Business Sales Tracker Worksheet for Excel