It is important to keep a record of one’s assets for various purposes. An individual may own several assets and may want to maintain their list for his ease. This list is referred to as a personal assets inventory.

What is a personal assets inventory?

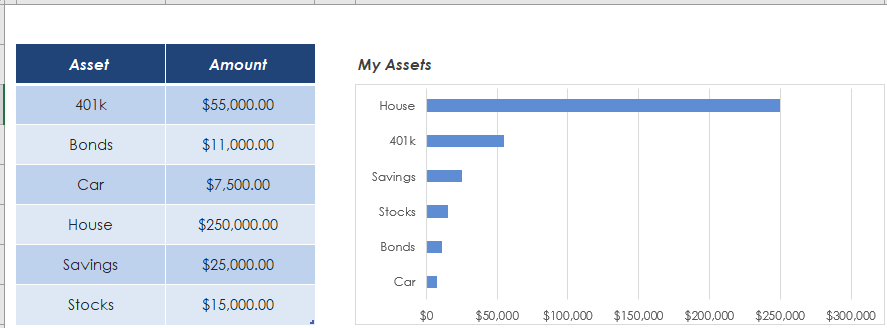

A personal assets inventory is a record of the personal assets one owns, both self-purchased and inherited. It provides all the relevant details of one’s assets. The list of the assets can include cash, cash equivalent certificates, treasury bills, property, cars, or other vehicles, etc. Usually, the list contains physical and tangible assets only as an individual may not have any intangible assets that have a market value, and they are difficult to evaluate as well. One can assess one’s financial position in terms of one’s assets, by reviewing this spreadsheet.

What are the benefits of a personal assets inventory?

There are many benefits of maintaining a record of the personal assets, which is why the individuals, who are rich and have different assets prefer to list them down. Some of the advantages are stated here:

- Indicates the ownership status

This inventory list provides a reflection of the number of assets purchased, sold, and owned by an individual.

- Helps in the analysis of one’s financial position and making the right decisions.

The net worth of a person in monetary terms can be measured through this list, and the relevant decisions can be made. For instance, if a person has a lot of cash, he/she might want to invest it to generate more money through it. As this list states the value of the assets, it would assist in making the right choices about further investments.

- Aids in seeking loans, immigration, etc.

The financial institutions, embassies, or governments may require a list of assets, owned by a person, who is applying for a loan, mortgage, immigration, etc. This list also shows the creditworthiness and financial credibility of that individual to those authorities as well.

- Assists in the calculation of taxes.

The personal taxes need to be calculated and paid on time. The timely payment of the taxes is the individual’s duty, which can easily be carried out if one has a detailed list of one’s assets with their values.

- Helps in figuring out the insurance payments.

By looking at this list, the person can separate the assets, for which the insurance payments are to be made, from others, to calculate the payment amount.

What are the main components of a personal assets inventory?

The components of this inventory list vary depending on the type of assets owned, the number of the assets owned, and the requirements of the details the owner wants to record. However, generally, the following details are included:

- Serial number.

- Description/name of the asset, including the model, version, edition, etc.

- Warranty.

- Date of purchase.

- Purchase price.

- Dealer or shop information, from which the asset was purchased.

- Mode of payment.

- Remaining payment, if any.

- Current worth/value of the asset.

- Asset sold.

- Selling price.

- Total asset value owned.

- Remarks, if any.