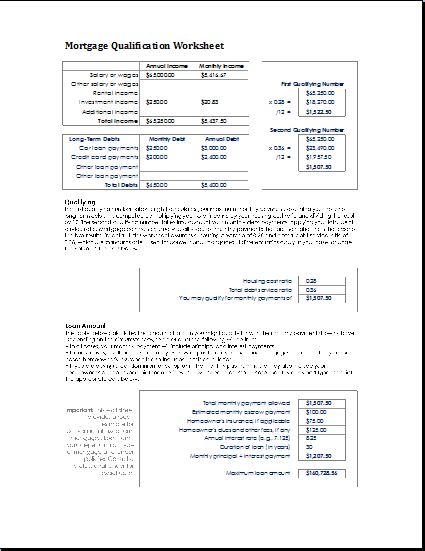

Mortgage Qualification Worksheet

A mortgage qualification worksheet is used by lenders and renters to monitor the financial health of the renter. It evaluates the financial position of the borrower to assess if he can pay the mortgage for a particular property or entity. Many money lenders collect information to make sure that borrowers will be able to return loans either in installments or at once over a specific period of time.

Based on the borrower’s financial situation, lenders decide the amount of loan that can be issued to the borrower. Moreover, monthly installments time and amount are also pre-decided to avoid inconveniences later on. Borrowers are responsible for retiring the whole amount over a specific time period otherwise they can be held in contempt.

A mortgage qualification worksheet can be used for drawing up a contract between lender and borrower which may include witnesses to make sure that both parties understand the terms and conditions of a mortgage. These worksheets can be used as evidence in a court of law because they have all the data required for proving the financial condition of an individual.

Contents of the worksheet

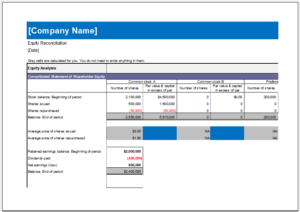

Although, the mortgage qualification worksheet requires all information about sources of income and expenditure of an individual some of the detailed information about the following topics is also included,

- Sources of Income: all types of individual income sources are considered. These income streams may include self-employment, job, business, or any other kind. Documentation of tax and monthly fee slips should be attached to the worksheet for a complete analysis of total income.

- Assets: all types of assets in land, jewelry, savings, and others are considered assets that can be used in a time of need. These assets significantly improve the financial condition of the individual because these can add to the finance and also increases the amount of loan.

- Expenditure: all streams of expenses are noted to assess the financial condition of the individual. Some of these expenses may include housing rent, utilities, insurance, and other payments to assess the financial responsibility of the loaner. It helps lenders to evaluate if the borrower is capable of paying mortgage installments along with all regular expenditures.

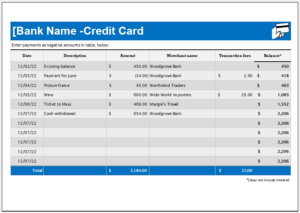

- Debts: this section of the mortgage qualification worksheet entails all the other debts and loans that the borrower has to pay. These loans may include house or car loans, student loans, installments, credit card loans, etc.

All the above-mentioned information is the major deciding factor in signing off on a particular loan. Although, borrowers are required to keep their valuables, hostage, for using loans their financial condition is assessed to make sure that loan will be paid off.

It is a major document…

A mortgage qualification worksheet is a major document for lenders as well as borrowers because of the following reasons,

- Lenders can decide the debt-to-income ratio to evaluate the maximum mortgage that can be signed off.

- It helps borrowers in minimizing their expenses to meet their loan installments.

- It is a formal document that can be used as proof and attached to a mortgage qualification worksheet.

← Previous Article

Semi Monthly Home Budget TemplateNext Article →

Parent Teacher Communication Log