An expense claiming form is a document used by employees to submit claims of reimbursement for expenses they have incurred while conducting business on behalf of their employer. Employees can use these forms to organize and record their expenses, and employers can use them to review and approve employee reimbursement requests.

Contents of the document

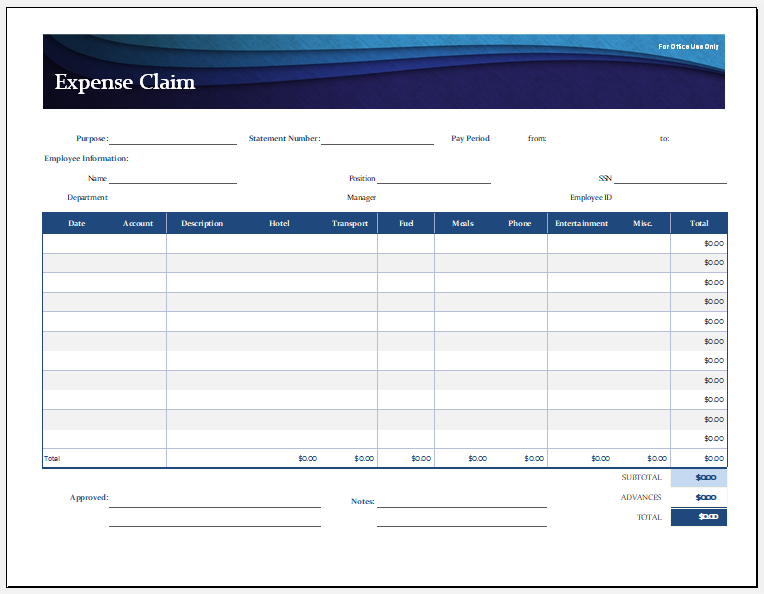

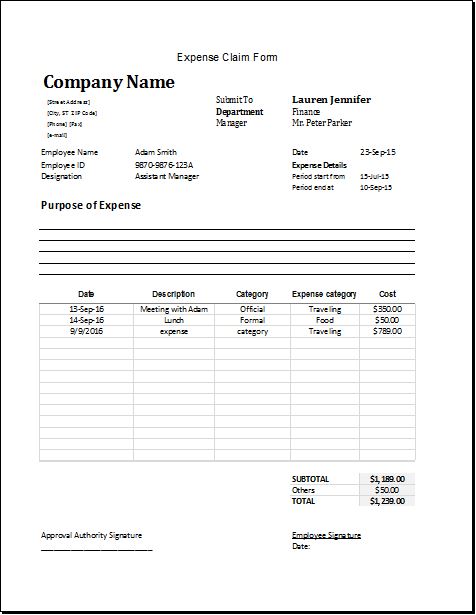

An expense claim form should include the following information:

- Name, department, and contact details of the employee: These details will enable the employer to track the individual and get in touch with them if there are any queries regarding the expense claim.

- Date, location, and purpose of the expense: These details will help the employer understand the context of the expense and why it was incurred.

- Itemized list of expenses: This must include the cost, the source or vendor, and a brief explanation of the expenditure.

- Supporting documentation: Employees should include any necessary receipts or other proof when submitting an expense claim.

- Additional details or notes: This can indicate whether the cost was incurred for a training session or business travel, or whether it can be charged to a client or customer.

- Approval section: This should have a space for the manager or supervisor of the employee to approve the expense report.

- Signature: The employee’s signature on the form should attest to the truth and accuracy of the data provided.

- Date of submission: The expense claim form should be dated as to when the form was submitted for reimbursement.

Importance of the document

The expense claim form provides an organized manner for employees to register their expenses, making it easier for them to keep track of their spending and for the employer to review and approve the expenses. The form also helps in keeping transparency between the employees and the employer by allowing them to itemize their spending, giving a clear picture of what was spent and why. This can also aid in the prevention of fraud.

The form can assist in ensuring that the expenses claimed are by company rules and processes, as well as applicable laws and regulations. In addition to compliance with the laws, the expense claim form also aids in maintaining efficiency as it simplifies the expense reimbursement procedure, making it easier for employees to get reimbursed for their expenses as well as for employers to process and approve the reimbursement.

It helps correct the records…

The claim form helps firms in the maintenance of correct expense records, which can be useful for budgeting and financial planning, as well as tax and audit purposes. By putting all the relevant information in one location, the forms make the reimbursement procedure simple and uncomplicated. Similarly, by offering a clear and organized means of asking for and approving expenses, the forms can improve communication between employees, supervisors, and the finance department.

Lastly, the form enables the employer to keep track of the company’s expenses, identifying areas for cost reduction and ensuring that the organization is not overspending. This cost control can further increase the employee-benefit budget of the company and help the employees in return. In this way, the process is incentivized for the employees, and they feel motivated to keep all the checks while incurring expenses and when requesting reimbursement using an expense claim form.

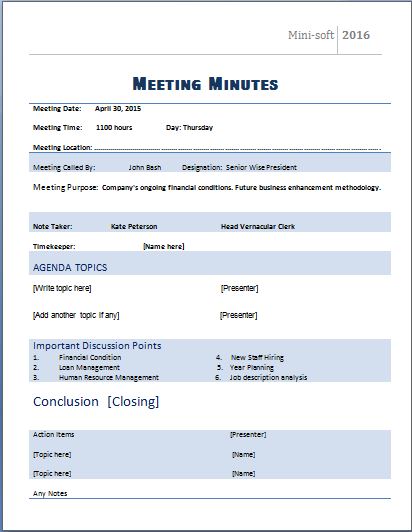

[Template]

File Size: 44 KB