When a company, business or even an individual buys a product, he receives an invoice for the payment. An invoice is a proof of the goods purchased from the vendor and the amount owed due to a transaction. Invoices are retained and maintained by the accounts department of any company. The accounts department makes sure to confirm the invoice and makes the payment.

An open invoice can be used by and for any business. The main objective of any invoice is to receive the payment on time for the goods or services delivered. An open invoice will always include the amount owed which needs to be paid/received along with the due date. The invoice will also mention any outstanding payments owed by the company. This invoice is sent directly to the payables or accounts department of the company, where the invoice will be confirmed and the payment will be processed.

The accounts department on receiving the invoice verifies the invoice. The amount owed and the purchases made will be verified. Once the verification has been done, the payment will be processed. The due date and mode of payment are pre-decided with the vendor. The payment terms are mentioned on the invoice.

Once the invoice has been paid for, the accounts department will cross off any payables with the purchases made. This helps the vendors and the accounts department to keep a track of all the transactions being made.

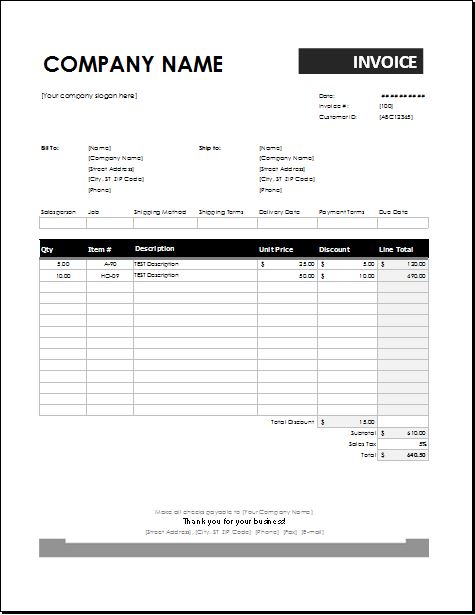

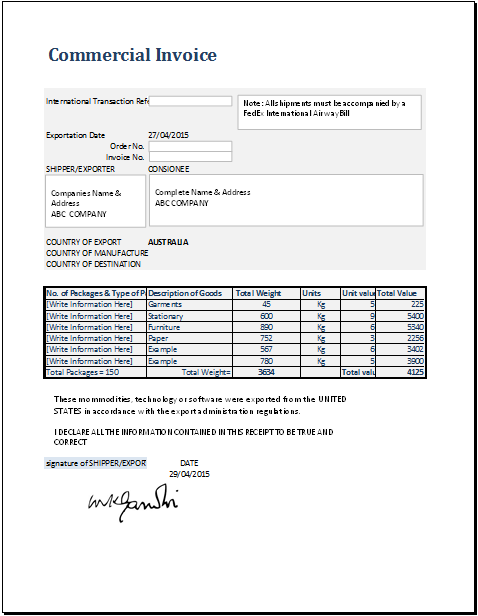

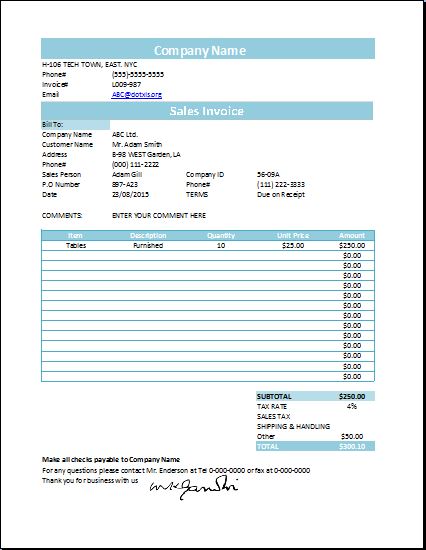

An open invoice includes:

- Name and contact details of the vendors

- Type of invoice i.e. receivable or payable

- Due date of the payment

- Invoice number

- Terms of payment.

- Date on which the invoice was issued

- Aging of the invoice

Remaining balance/outstanding balance

Preview

File Format: MS Excel; Size 40 KB