Food Bill Format with GST

When customers dine-in in a restaurant, they are issued a food bill. This bill is also issued to people when they render the takeaway service of the restaurant. A restaurant food bill is an important piece of the document since it helps the restaurant keep a record of the profit it makes each day.

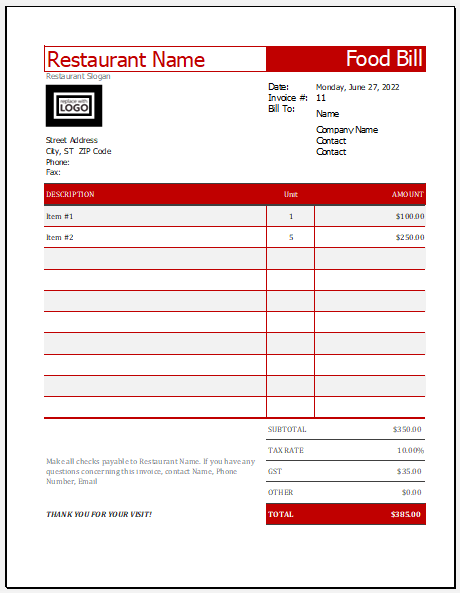

Food bill:

A restaurant needs to have a professional-looking food bill that can be used to bill the customers. This food bill is also known as an invoice that has information about the food items the customer has purchased from the hotel.

When a restaurant issues a food bill, the customer comes to know how much bill he is required to pay. The amount of tax the customer has to pay along with the total bill is also mentioned in the bill. Mentioning GST in the food bill is essential as it forms the basis of the tax paid by the restaurant.

What is a food bill format?

As a matter of fact, there is not so complicated thought process behind creating the invoice of the restaurant. Most hotels usually have a standard format that every hotel follows. It is recommended to use the standard format so that the food bill issued by your restaurant does not lose its identity.

How to follow the format of the restaurant invoice?

Restaurants need to follow the standard format just because they don’t want to look awkward. Additionally, when you follow the standard format, you make it easy for the customer to understand the bill since he knows which detail regarding the bill is to be expected and where.

To be able to follow the format, we recommend you to have a look at the food bill of some other restaurant. These formats will let you know so much about the formatting of the food bill.

Another way to follow the format is to download the food bill with the GST template and fill it with the necessary details. Once you finish adding the details, the form is ready to be used.

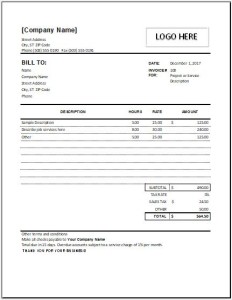

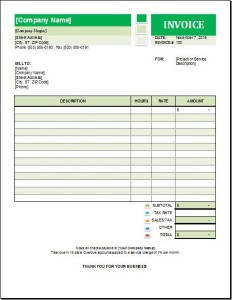

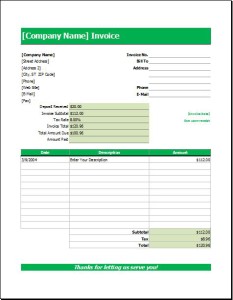

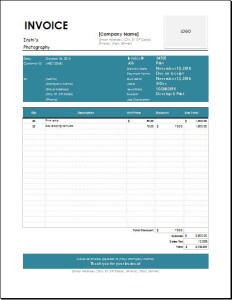

The general format of the bill:

Here is a detailed description of the format of the food bill:

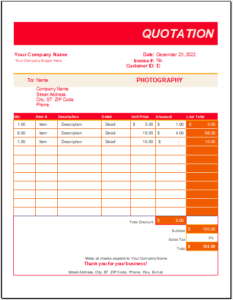

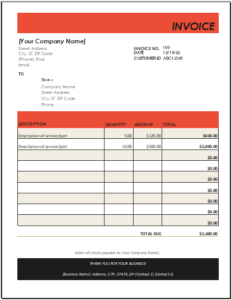

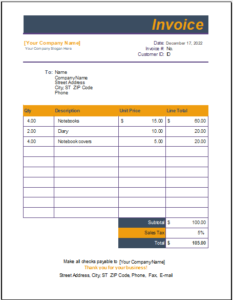

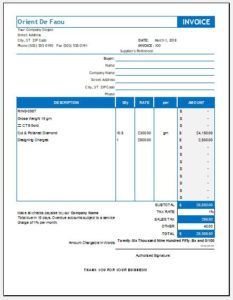

- Mention the name of the restaurant and logo on the top of the bill or invoice

- Mention the complete address and contact details of the restaurant

- Mention the name of the manager of the restaurant in the header area of the bill

- Write the name of the person to whom the bill is going to be issued

- On the right side of the bill, add some other details such as the date of issuing the invoice, a unique invoice number, etc.

- Make an itemized list of food items the customer has ordered. In general, a separate table is made on the food bill that accommodates the description of the food that was ordered

- Write the price of each food item in front of its name

- Show the total amount to be paid by the customer in the Total section of the food bill

- Add the GST to the total bill. When you are adding GST, you should try to make a separate column for this information. This enables the customer to emphasize the GST also.

- At the end of this bill, you can write a thank you statement for the customer. This is the best way to show gratitude to the customer.

Advantages of good food bill format:

Restaurants are always advised to follow the format because:

- It makes them get a professional look. The bill goes out to every customer who visits the restaurant. Therefore, the format of the bill should never be overlooked.

- Following the right format increases the readability of the bill. The customer easily understands the bill and its content when the bill is formatted in the right way.

- Some states have a rule that every restaurant must mention the GST on the food bill. Adding the GST is the main part of the format of the bill without which, the bill can never be considered complete.

[.xls file format]

← Previous Article

Breakeven Analysis Calculator TemplateNext Article →

One Week Payslip Template