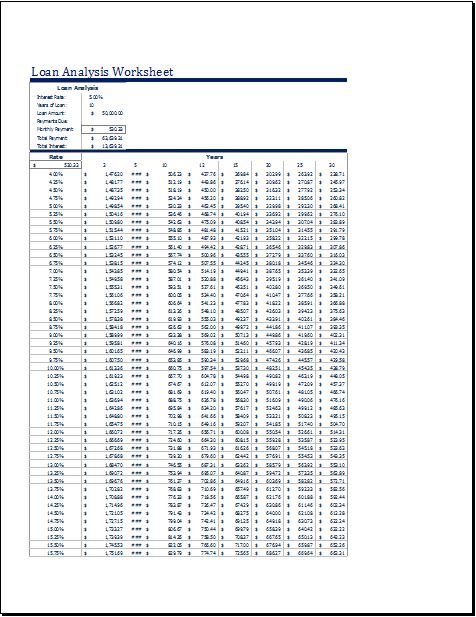

In the world of finance, a loan analysis worksheet is an essential tool for both borrowers and lenders. This worksheet is a comprehensive overview of the borrower’s financial situation, which enables lenders to evaluate their creditworthiness and make informed decisions about granting loans.

The worksheet provides borrowers with a roadmap to help them understand their financial situation and make informed decisions about borrowing money. Adequate use of a loan analysis worksheet can help reduce financial risk for both borrowers and lenders, leading to better financial outcomes for all parties involved.

However, the worksheet is not without its limitations, and lenders and borrowers must take these limitations into account when using it. To maintain analysis accuracy, the onus is on the borrowers to provide accurate and up-to-date information, similarly, lenders must take into account external factors that may impact the borrower’s financial situation.

Moreover, all the parties involved should also take into account some non-financial factors that can impact the borrower’s ability to repay the loan.

Contents and sections of the worksheet

A loan analysis worksheet typically includes the following sections

- Personal Information: This section includes the borrower’s name, address, contact information, and other personal details. This information is crucial as it helps the lender to verify the borrower’s identity and determine their location.

- Employment Information: This section includes the borrower’s employment status, income, and job history. This information helps the lender evaluate the borrower’s ability to repay the loan.

- Credit History: This section includes the borrower’s credit score, credit history, and any outstanding debts or loans. The credit score is a crucial factor in determining the borrower’s creditworthiness, while the credit history provides the lender with insights into the borrower’s past credit behavior.

- Loan Details: The amount of the loan, the term of the loan, and the interest rate are specified in this section. Lenders use this information to evaluate the borrower’s ability to repay the loan and to determine the borrower’s monthly payment.

- Collateral: This section lists the assets that the borrower is willing to pledge as collateral for the loan. Collateral provides the lender with security in the event of borrower default.

The sheet is used by borrowers and lenders

The loan analysis worksheet is used by both borrowers and lenders. For lenders, it is a valuable tool for evaluating the creditworthiness of potential borrowers. Lenders benefit from the load analysis worksheet as they can analyze the borrower’s financial situation and eventually determine the borrower’s ability to repay the loan and make informed decisions about whether or not to approve the loan. For borrowers, the worksheet is a valuable tool for understanding their financial situation and making informed decisions about borrowing money.

The best tool in the world of finance

The loan analysis worksheet is a critical tool in the world of finance. It provides lenders with a comprehensive overview of the borrower’s financial situation, which enables them to make informed decisions about granting loans. For borrowers, the worksheet serves as a roadmap to help them understand their financial situation and make informed decisions about borrowing money.

The worksheet is also significant because it helps to protect lenders from financial risk. Lenders’ decision-making regarding loan repayment is more informed if they use the loan analysis worksheet to evaluate the borrower’s financial situation. This reduces the risk of borrower default and ensures that the lender is protected against financial losses.

Preview