A personal money spending tracker is a tool that allows people to keep track of their monthly expenses and be more aware of their financial health. These trackers have been proven to be of great significance because of the ease they provide in recoding all the information related to income as well as spending of an individual.

Personal money-spending trackers are usually used by independent individuals, who live alone and do jobs to make ends meet. It is necessary to keep a record of your expenses because it can prove to be beneficial in the future. There are various types of trackers that are used by individuals. These trackers differ based on the features they provide i.e. ease of use, data storage, etc.

Types of money trackers

Some commonly used money-spending trackers include,

- Worksheet/ledger: these trackers are paper-based and require manual input of information. They can be used for a long period of time and are preferred by individuals who love paper-based products and writing. However, it is difficult to keep a stack of worksheets every month because they tend to accumulate. Keeping them safe and on oneself at all times can be very difficult.

- Spreadsheet: a spreadsheet is usually an Excel sheet that can be accessed through an electronic device. It can be used for entering a large amount of data and require minimal storage. The spreadsheet of every month can be arranged in separate folders however, it does not provide digital features.

- Application: mobile-based applications have revolutionized the concept of money-spending trackers. These trackers allow you to categorize your spending and keep a check of your expenses to the precision of a cent. Pictures of various receipts can be attached to the individual categories as proof of spending. These applications provide timely reminders of entering data each month and also allow you to keep a check on your savings.

Information and data collection

Money spending trackers require data about one’s expenses to create a full image of their income spending. Information can be added in the following order,

- Mention income from all resources to make sure that every incoming penny is accounted for.

- Make categories of all your expenses and how much you need to spend for each category.

- These categories may include rent, food, grocery, transportation, fuel, dining out, home renovation, vehicle installments, utilities, etc.

- Money spent on each category is mentioned before the category. If necessary, a break up of the total can also be added.

- Calculate all your expenses and savings and make your goal to save more in the coming time.

Benefits of using the tracker

Keeping a record of one’s expenses can be a tiring job but these trackers do the difficult work. Some of the benefits of using a personal money spending tracker include,

- It helps in categorizing your income based on priorities and life necessities.

- By keeping a close check on your expenses, overspending can be avoided to maintain a healthy budget.

- Savings can be done each month by cutting out on expenses that are not essential and can be sued for something substantial.

- Keeping track of expenses, a budget can be devised and trackers help you in remaining on your decided budget and avoid overspending.

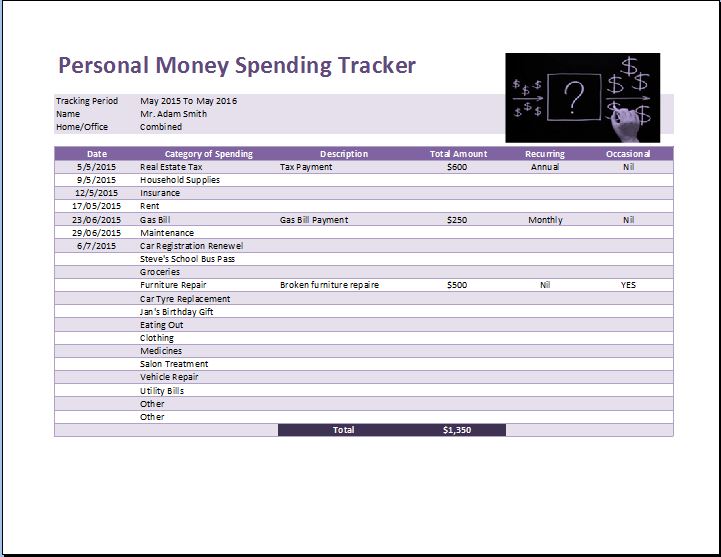

Preview