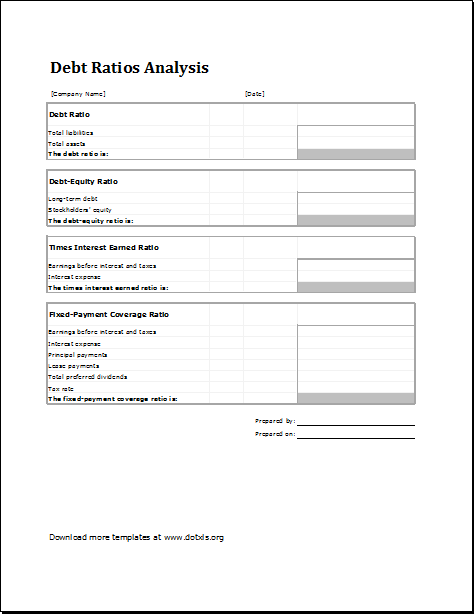

Debt Ratio Analysis Worksheet

Debt ratio in financial settings is a metric used to evaluate a company’s ability to repay its debts. To calculate the debt ratio, a financial tool, a debt ratio analysis worksheet is employed. The worksheet provides instructions to calculate the debt ratio and is an essential tool for investors and creditors who need to assess a company’s financial health and creditworthiness. Although a very useful tool in financial settings, it has some limitations as the debt in context can be limited and might not include off-balance sheet items.

Procedure

To perform a debt ratio analysis, follow the steps below:

- Determine Total Liabilities: A company’s balance sheets provide the total liabilities of a company.

- Determine Total Assets: All the assets owned and maintained by the company.

- Calculate the Debt Ratio: The debt ratio is calculated by dividing a company’s total liabilities by its total assets. The resulting ratio represents the percentage of a company’s assets that are financed by debt. The formula is given as:

Debt Ratio = Total Liabilities / Total Assets

It is used by creditors and investors

Debt ratio analysis is commonly used by investors and creditors to evaluate a company’s financial health and creditworthiness. Some common use cases for debt ratio analysis include:

- Creditworthiness Evaluation: Creditors use a debt ratio analysis worksheet to evaluate a company’s creditworthiness before issuing a loan or extending credit. A higher debt ratio indicates that a company may have difficulty repaying its debts, which may make it a riskier borrower.

- Investment Analysis: Investors use a debt ratio analysis worksheet to evaluate a company’s financial health and determine its growth potential. In this scenario, financial stability and room for growth in a company are indicated by a lower debt ratio, while a higher debt ratio may indicate that a company is highly leveraged and may be at risk for financial distress.

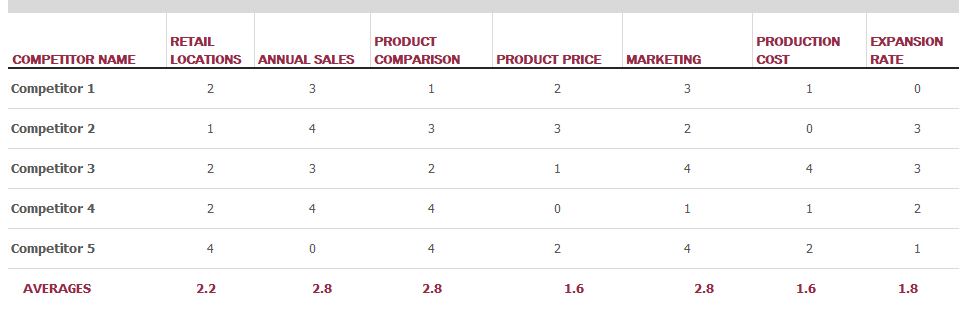

- Industry Comparisons: A debt ratio analysis worksheet can also be used to compare companies within the same industry. This allows investors and creditors to identify companies that are performing better or worse than their peers and make more informed investment and lending decisions.

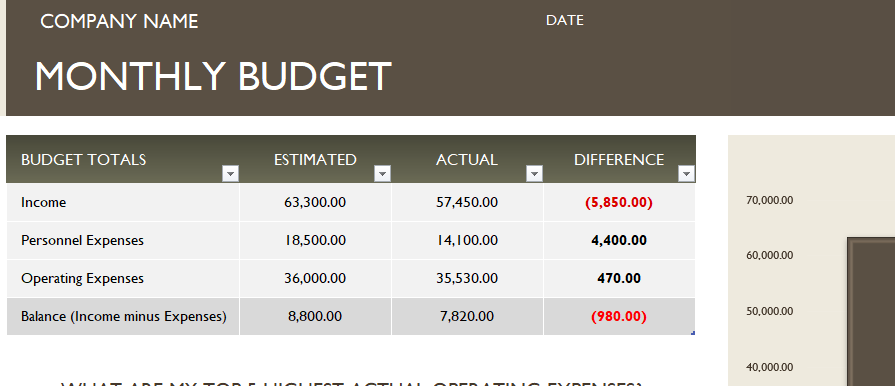

It is significant in evaluating the financial health

The debt ratio analysis worksheet is significant in evaluating a company’s financial health and creditworthiness. It provides insight into whether a company can repay its debts or not. It also indicates the extent to which a company is reliant on debt financing. Financial distress is indicated by a higher debt ratio while room for growth and financial stability are indicated by a lower debt ratio.

Creditors and investors, who need to make informed decisions about lending and investment benefit greatly from a debt ratio analysis worksheet.

Limitations

While debt ratio analysis can be a useful tool for evaluating a company’s financial health, it does have some limitations. One of which is limited context. The debt ratio provides a snapshot of a company’s financial health at a particular point in time. It does not take into account the company’s financial history or prospects, which may be important factors to consider when evaluating a company’s creditworthiness.

Furthermore, different industries may have different average debt ratios, which can make it difficult to compare companies across industries. For example, a company in a capital-intensive industry such as manufacturing may have a higher debt ratio than a company in a service industry such as consulting.

While performing the debt ratio analysis, there might be some discrepancies as the analysis may not include all of a company’s liabilities, particularly those that are off-balance sheet items. This can make it difficult to get a complete picture of a company’s financial health.

← Previous Article

Calorie Amortization Schedule with Nutrition TrackerNext Article →

Vehicle Logbook Template