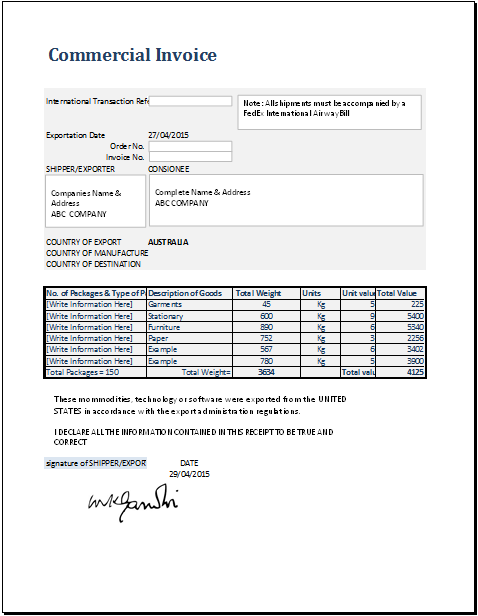

Commercial Invoice

Commercial invoices are generally used when the import and export of products take place. They are generally more common in the situation where foreign exchange of products happens. Although they are referred to as commercial invoices, their purpose and use are the same as the conventional invoice.

What is a commercial invoice?

Whenever a product is sold out from an exporter, also known as the seller to an importer, also known as the buyer, an invoice is generated which is known as a commercial invoice. This invoice contains information about the transaction between the importer and the exporter. It is also regarded as a formal request from the seller of the products to the buyer to pay them for the products that they have purchased.

An invoice plays a very important role in the trade process as all the parties and individuals are informed about the charges and payment and no one remains uninformed. This way, there are less chances of any dispute.

Why a commercial invoice is deemed important?

When products are shipped from one country to another, they need to get customs clearance. The customs authorities deem a sale legal and lawful if it has an invoice attached to it. They read the invoice and gather briefs of the transaction. After that, they allow a product to be shipped. Things become very easy for the seller as well as the buyer when they use a commercial invoice. They are also important for the following reasons:

- A commercial invoice always helps the seller and the buyer in the processing of the payment. When the buyer receives it, he comes to know how much he is required to pay. This way, processing of the payment becomes easy.

- It also handles all disputes professionally. If there is any disagreement or the product received was not up to the mark, the buyer will need it to prove that the transaction did happen and the invoice is its tangible evidence.

- It makes the import-export process simpler and more convenient as it is often complex as so many authorities such as tax authorities, custom team, shipping officers, etc. are involved.

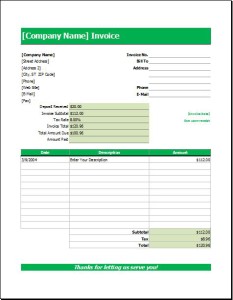

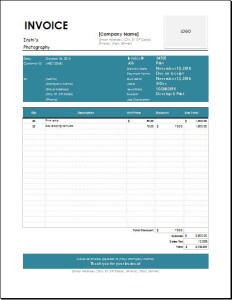

What are the common elements of the commercial invoice?

If you are going to start your new business and you want to know how to design a new commercial invoice, you should include the following elements to it:

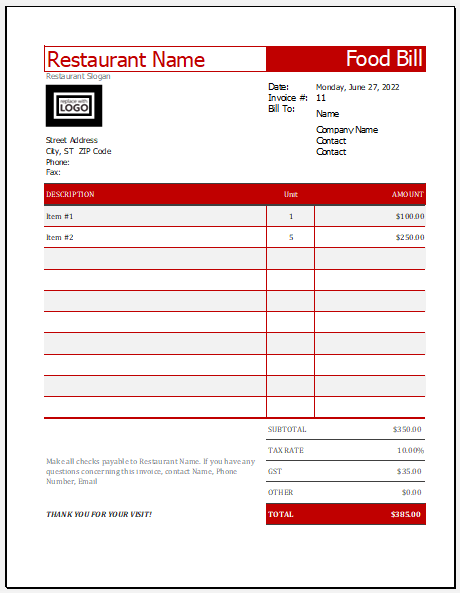

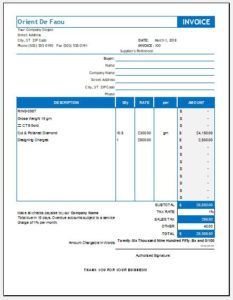

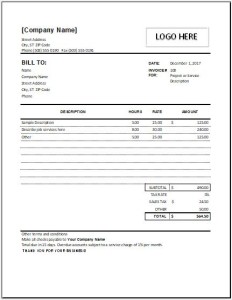

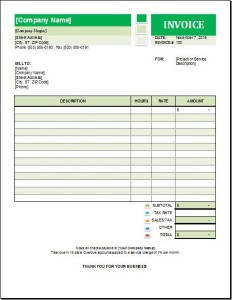

Name of the business and logo:

An invoice that your business issues should show its association with your business. So, mention the name of the company as well as its logo in the header section. You may also add your contact details and license number to show that your brand is a registered brand.

Details of the seller and buyer:

An invoice is incomplete if details of both parties involved in the transaction are not given. Therefore, it should specify the names, addresses, contact details, countries of origin, and everything regarding the seller and the buyer.

Total bill:

An invoice shows the total amount to be paid by the buyer. It usually shows the complete breakdown of the cost of the product including shipping charges, GST tax, withholding tax, and much more. These details are essential for the buyer as well as for the customs authorities as they have to know if you are paying the tax properly or not and it totally depends on the total bill.

Terms and conditions:

Just like any other invoice, this one also mentions the conditions under which the transaction is taking place. This section of the commercial invoice protects the rights of both parties. The buyer should read it carefully because he cannot go against them or refuse to accept them once he has accepted the imported product and paid for it.

Agreed upon the mode of payment:

The invoice also mentions the method using which both seller and the buyer have agreed to complete the process of the transaction.

Details of the shipment:

The invoice never tells what is inside the shipment. However, it gives some brief details such as the weight of the shipment, the names of the source and destination of the shipment, the date on which the shipment has been sent, and much more. These details are mandatory to be mentioned on the parcel.

- Security Deposit Forms

- Used Bike Sale Receipt

- Coffee Shop Daily Sales Report Template

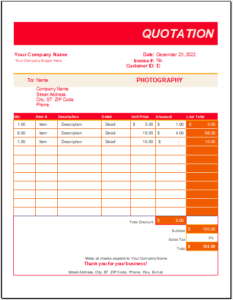

- Photography Business Quotation

- Computer Repairing Bill Format

- Stationery Bill Format & Template

- Baby Shower Guest Food & Task Planner

- Business Planning Checklist Template

- Event Financial Planner

- Breakeven Analysis Worksheet for Small Business

- Credit Card Use Personal Log

- Equity Reconciliation Report Worksheet

← Previous Article

Daily Weekly and Monthly Sales ReportsNext Article →

Daily Workout Log